The days of rifling through spare change for school fees, civvies days, or the tuckshop are numbered. School payment systems play an essential role in managing financial transactions, yet many institutions still rely on outdated, manual processes. From handling physical cash to reconciling paper receipts, these methods often create more problems than solutions.

As South Africa’s education system becomes increasingly digital, with online learning platforms, e-assessments, and smart classrooms, payment processes also need to evolve. Whether it’s collecting tuition fees or selling uniforms, sticking with cash or manual records is not just inconvenient. It creates inefficiencies, risks financial mismanagement, and impacts parent satisfaction.

In this guide, we unpack the true cost of outdated payment systems in schools and demonstrate how transitioning to digital, cashless platforms can save time, mitigate risk, and provide a better experience for both administrators and parents. Whether you’re an administrator, a finance officer, or a principal, this practical overview will help you understand why modernising your payment system is no longer optional — it’s essential.

Table of Contents

Introduction to the Problem with Outdated Payment Systems

If your school still relies on physical cash or manual payment approaches, you’re not alone. However, the inefficiencies add up more than you might realise. Here’s why outdated payment systems can be a heavy burden for schools:

- Time-Consuming Tasks: Processing cash-based transactions is time-consuming for administrative staff. From counting money to reconciling accounts, these tasks take valuable hours out of their week.

- Security Risks: Physical cash on-site increases the risk of theft or mismanagement..

- Inaccurate Recordkeeping: Paper-based systems make tracking payment histories or flagging outstanding balances difficult.

- Parental Frustration: In today’s fast-paced world, asking parents to bring exact change or visit the school office is often seen as inconvenient and outdated.

The solution? Switch to cashless payment systems designed specifically for schools.

5 Reasons to Ditch Outdated Payment Systems in Schools

While some schools believe they are saving money by avoiding digital platforms, it’s important to recognise the hidden costs of cash-based systems, such as:

Reason 1: Administrative Overhead

Managing payments manually requires more administrative staff to count, record, and reconcile funds, especially in larger schools. This increases payroll costs and leads to burnout among staff managing high volumes of transactions.

Reason 2: Mismanagement and Errors

Even well-organised admin teams make mistakes. Whether it’s misplacing a receipt, entering the wrong amount, or misallocating a payment, human error is a constant risk with manual systems.

Reason 3: Security Concerns

Cash-heavy environments increase the risk of theft, both internal and external. Handling, storing, and transporting cash not only creates security vulnerabilities but can also drive up insurance costs.

Reason 4: Missed Opportunities for Efficiency

Without real-time reports, schools cannot forecast income accurately or identify trends in overdue accounts. Manual systems limit your ability to respond quickly to financial issues or extract valuable insights, such as tracking best-sellers in the tuckshop, managing inventory, or forecasting budget trends.

Reason 5: Reduced Engagement with Parents

Parents increasingly expect the convenience of digital payments. When schools rely on cash-based systems, they not only create unnecessary friction for busy families but also risk appearing outdated, making fee payments less accessible and parent engagement more difficult.

What Is a Cashless School (and Why Is It Better)?

A cashless school is an institution that utilises digital payment methods for all transactions, thereby eliminating the use of physical cash. Whether it’s tuition fees, field trips, or canteen purchases, parents and students can handle everything through online platforms or apps.

Moving beyond outdated systems isn’t simply about ditching coins and handwritten receipts. It’s about reimagining how schools handle financial transactions entirely. A cashless school adopts technology to manage every stage of the payment journey, from initial invoice to reconciliation.

These systems can include point-of-sale (POS) terminals for on-site purchases, QR payment options for events, and fully integrated mobile apps for everything from school fees and aftercare payments to permission slips and parent notifications. The aim is to create a seamless, flexible, and user-friendly ecosystem that benefits administrators, educators, parents, and learners alike.

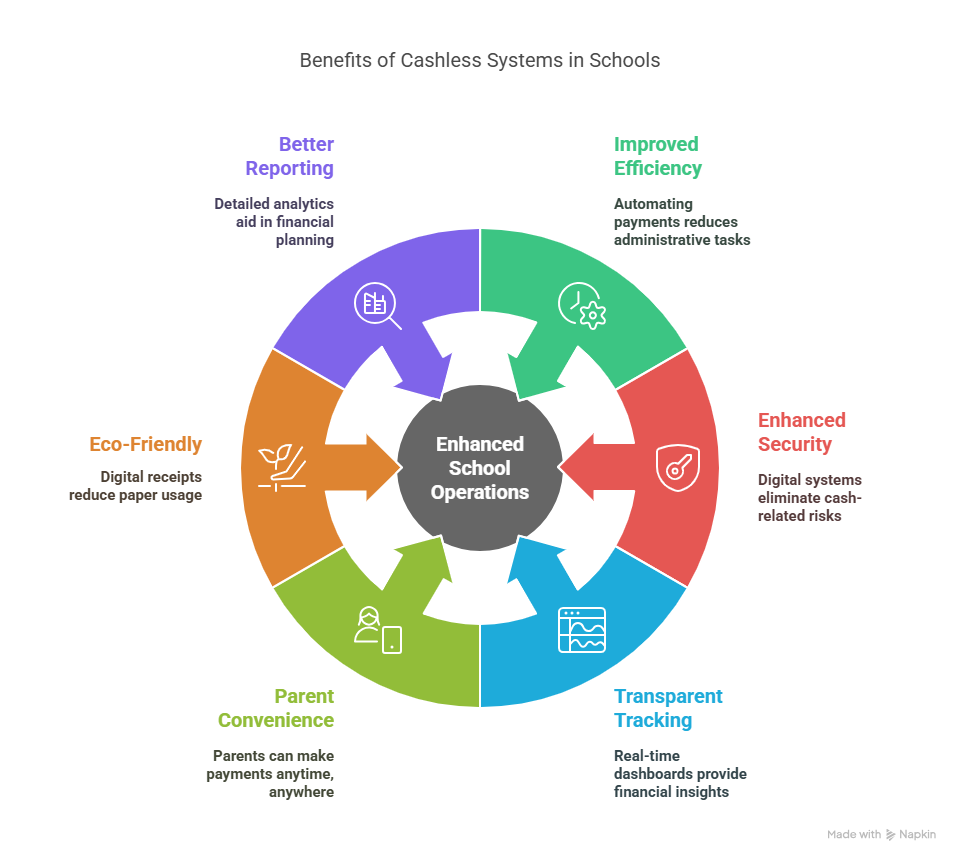

Key Benefits of Going Cashless

Here’s why ditching outdated systems for cashless alternatives should be a priority for every school:

- Reduced Admin Load: Staff no longer need to manage physical money, reconcile spreadsheets, or chase payments.

- Increased Security: Digital systems reduce the risk of theft and provide encryption and role-based access controls.

- Real-Time Tracking: Schools can instantly see who’s paid, what’s outstanding, and where funds are flowing.

- Parent-Friendly Options: Parents can make payments at any time and from anywhere. No more rushing to find exact change or making late-night trips to ATMs.

- Eco-Friendly: Digital systems reduce reliance on paper forms and printed receipts, supporting sustainability efforts.

- Faster Reconciliation: Accounting teams can generate reports, export transactions, and complete audits more efficiently.

Want a deeper dive into the benefits of going digital? Check out our related blog post: The 8 Reasons Cashless Digital Payments Reign Supreme in Schools

6 Steps to Implement a Cashless Payment System in Your School

Transitioning from a manual to a digital system may seem daunting, but with the right approach, it can be a smooth and rewarding process. Below are six essential steps that ensure a structured and successful transition for your school community:

Step 1: Assess Your School’s Current Pain Points

Survey administrative staff and parents to identify your current challenges. What are the biggest bottlenecks in your current process? Are parents regularly submitting late payments? Are you spending hours chasing receipts or correcting errors?

Step 2: Evaluate Cashless Payment Providers

Look for a system specifically designed for schools. Consider features like:

- Multiple payment methods (EFT, debit/credit, QR)

- Support for recurring payments and instalments

- Dedicated mobile apps

- Real-time payment tracking

- Parent communication tools

- Secure, POPIA-compliant infrastructure

- Affordable pricing plans

Step 3: Communicate the Transition

Start early and be transparent. Let parents know why the school is making the change and how it benefits them. Share setup guides, video tutorials, and contact info for support.

Step 4: Set Up and Test the System

Once you’ve chosen a provider, work with them to implement the system. Ensure it’s easy for staff to use and meets compliance requirements for handling sensitive financial data. Run a small pilot (e.g., just the tuckshop) before scaling.

Step 5: Train Your Staff and Parents

Host a short onboarding session for your team. Offer parents help via email, meetings, or video resources to ensure everyone can use the platform confidently.

Step 6: Monitor and Optimise

Use the built-in analytics to track payment trends, identify overdue accounts, and gather user feedback. Most platforms provide dashboards and reports to help you track adoption and improve processes over time.

Looking for a simplified, action-oriented guide? Read our related post: How to Become a Cashless School in 5 ‘Eezi’ Steps

Stay Ahead of the Curve: Why It Matters

Schools that embrace digital tools early are better equipped to handle future challenges, whether it’s managing growth, offering flexible payment plans, or ensuring compliance with evolving regulations.

More importantly, they meet the expectations of modern families who want fast, digital-first experiences, including how they pay. Going cashless is no longer a trend; it’s the new standard.

By switching to a smart school payment system, you can:

- Save time and reduce manual work

- Boost transparency and trust

- Improve family engagement

- Strengthen financial controls

Don’t wait for problems to arise; future-proof your school now.

Ready to Modernise? Here’s Your Next Step

Outdated systems don’t just create admin headaches; they send the wrong message in a digital world. From security risks to frustrated parents, the hidden costs of sticking with cash add up quickly.

With Eezipay, South African schools get a platform built for education. From secure mobile payments to real-time tracking and effortless fee collection, Eezipay helps schools modernise without the stress.

Whether you’re exploring options or ready to switch:

👉 Book a demo to see Eezipay in action,

📩 Contact us to learn how we can tailor a solution for your school, or

📘 Download our free eBook below to kickstart your journey toward a streamlined, cashless future.

It’s time for a payment system that works for your school—efficient, secure, and built for the future.